Every month, your bank receives hundreds or even thousands of loan applications. As a lender, your biggest goal is simple: give money to people and businesses who will pay it back on time. This decision process is called credit risk assessment—and getting it right decides whether you make a profit or suffer painful losses.

For decades, this was done manually. Experienced analysts studied bank statements, credit scores, job history, and collateral. These traditional methods worked, but they have clear limits: they look mostly at the past, often miss real-time changes in a borrower’s life, and simply can’t keep up with today’s volume of applications.

That’s why leading banks are now turning to custom AI solutions for credit risk assessment. By combining predictive analytics, real-time data, and machine learning, AI delivers faster, more accurate decisions while cutting costs and default rates. This article shows exactly how it works—and the results modern lenders are already seeing.

Old ways of assessing risk mainly use simple tools and reports, like analyzing past bank statements, looking at old debt records, and checking the value of any collateral. Banks also look at the borrower's job history and general market conditions.

While these old methods work somewhat, they rely too much on history. They often miss important, dynamic clues that are happening right now and affecting the borrower's ability to pay. To get a true picture of someone's financial health today, you need a system that can look at data in real time and see patterns that a human eye might miss. Building these Custom AI solutions is the key to creating a truly modern risk strategy.

Artificial intelligence brings a powerful new layer of technology that can analyze huge amounts of data at incredible speed. AI systems can look at regular, structured data (like loan amounts) and also unstructured data, such as public information from social media, news reports, and detailed transaction records. This gives the lender a much fuller and more detailed picture of a borrower's financial life.

AI significantly improves the power of scoring models by using smart machine learning programs that adapt and learn from new information. These models can spot subtle patterns and strange activities that a person might never notice, helping to predict risks with much greater accuracy than before. For instance, AI can analyze spending patterns or online activity to get a better sense of creditworthiness.

Unlike traditional methods, AI can process data streams instantly, giving lenders up-to-the-minute information on borrowers' current financial behavior. This speed helps lenders make quicker and more informed decisions. It means lenders can change credit terms instantly, matching their risk assessment to changes in a borrower's financial situation right away. Managing this complex strategic process is why many large financial institutions often seek guidance through ai consulting services before deploying these systems.

Using AI to manage credit risk brings several major advantages that significantly improve financial decision-making:

JPMorgan Chase & Co. uses machine learning to analyze customer data, helping them forecast potential future risks. By taking this proactive approach, the bank was able to see major improvements. Statistics showed that they reduced their loan default rates by 20% and cut operational costs by 15% within the first year of putting their AI systems to work. This shows that AI isn't just theory; it delivers tangible results.

AI has transformed credit risk assessment from a slow, backward-looking process into a fast, accurate, and proactive system. With real-time insights and smarter predictive models, lenders can cut defaults, approve loans faster, and save millions in operating costs—results already proven by institutions like JPMorgan Chase. If you're ready to modernize your risk strategy, contact us for a specialized financial AI consultation and start reducing your default rates today.

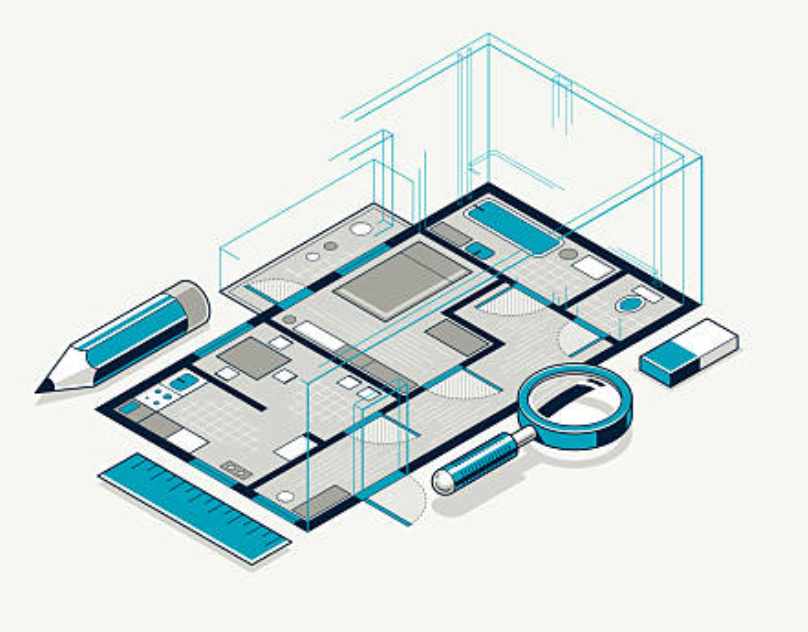

Unlock PropTech automation. Learn how our custom AI uses Computer Vision and geometric reasoning to extract data from floor plans, reducing costs.

.png)

Automate grading, curriculum mapping, and student records. See 5 top use cases where IDP and OCR transform academic operations.

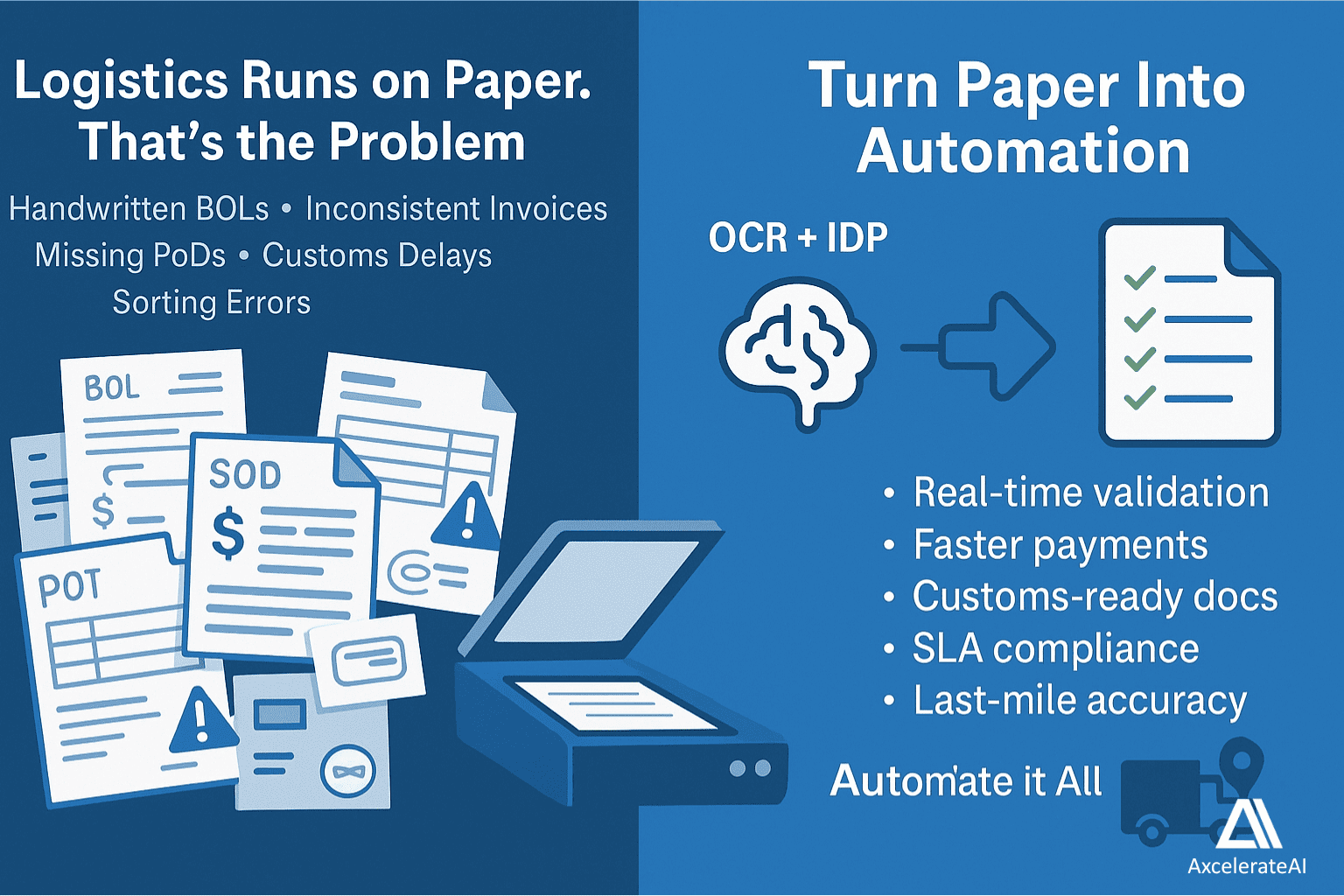

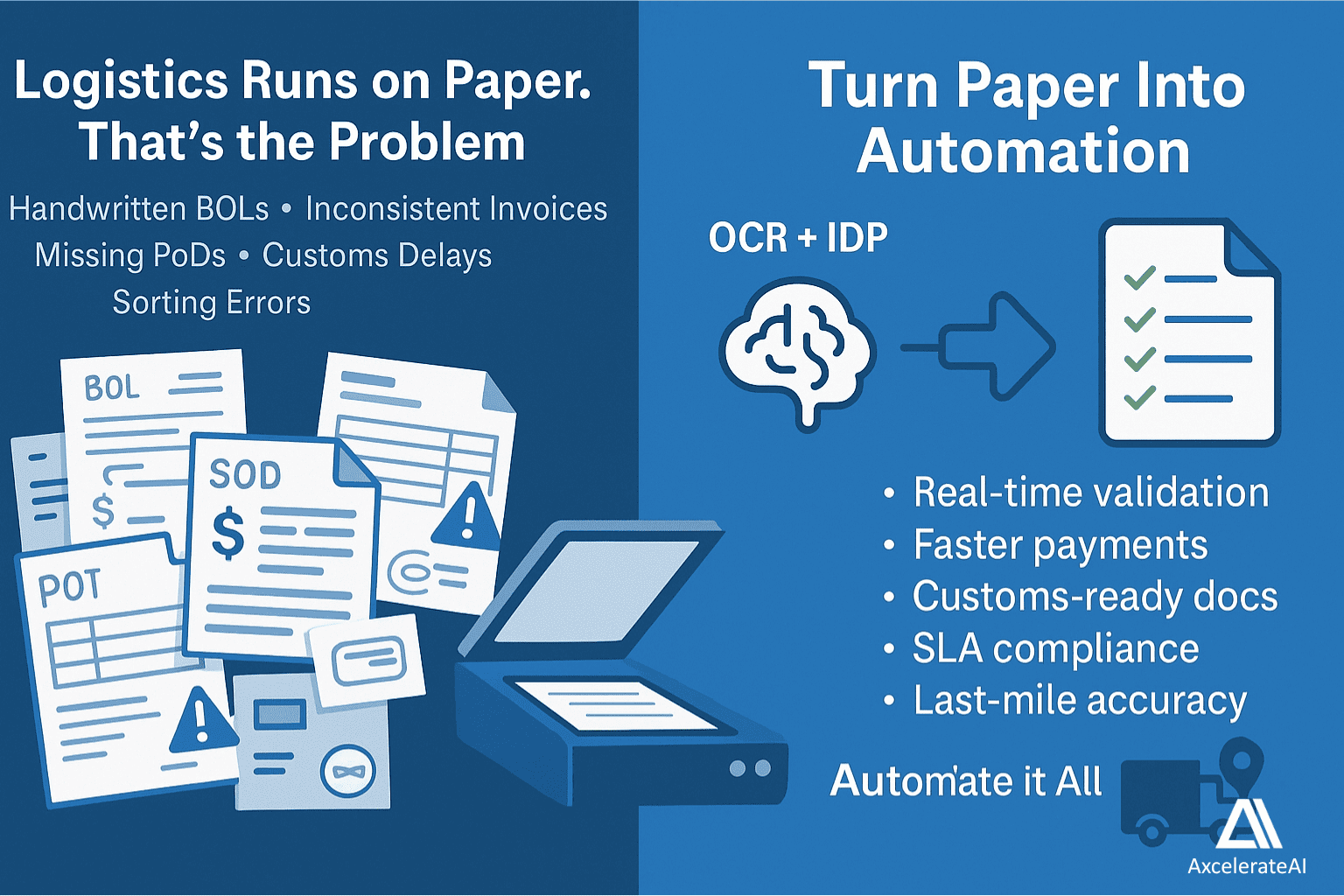

Unlock logistics efficiency with OCR and IDP: Automate inventory, supply chain tracking, and compliance. See real examples from DHL and Maersk.

Unlock PropTech automation. Learn how our custom AI uses Computer Vision and geometric reasoning to extract data from floor plans, reducing costs.

.png)

Automate grading, curriculum mapping, and student records. See 5 top use cases where IDP and OCR transform academic operations.

Unlock logistics efficiency with OCR and IDP: Automate inventory, supply chain tracking, and compliance. See real examples from DHL and Maersk.